Debbie Pizzino, Media Director at THOMPSON & BENDER, was able to answer some questions about her clients, Westchester Community College, media objectives with Hospital Placed Media.

1. Westchester Community College has been a client of Innovare Medical Media since 2020 and continues to invest in Hospital Placed Media (HPM) – what has been your experience?

SUNY-WCC is partnering with Innovare to build awareness of the many healthcare courses and workforce development programs offered at the college. Exposure in the identified locations/hospitals provides reach in key target markets.

2. Hospital Placed Media presents a valuable audience, including high household income, age, and education demographics. What is the marketing strategy for SUNY-WCC when targeting patients, visitors and/or healthcare professionals?

The marketing strategy is to ultimately grow enrollment at SUNY-WCC. HPM delivers a very targeted audience, allowing us to reach our core demographic in a relevant atmosphere when they are most likely to think about a healthcare-related career/opportunity.

3. By investing in HPM in 4 hospitals, WCC’s campaign gets over 10 million annual impressions from a highly valuable audience. What do you want this audience to know?

SUNY WCC wants the target audience to know about the healthcare course opportunities available at the college.

4. What has your experience been like working with the Innovare Medical Media team?

Our experience has been great working with the Innovare Medical Media team. Outreach and response have been strong and efficient. The team has been extremely nice and are easy to work with.

Tune in to Champions Unite on August 25, 2022

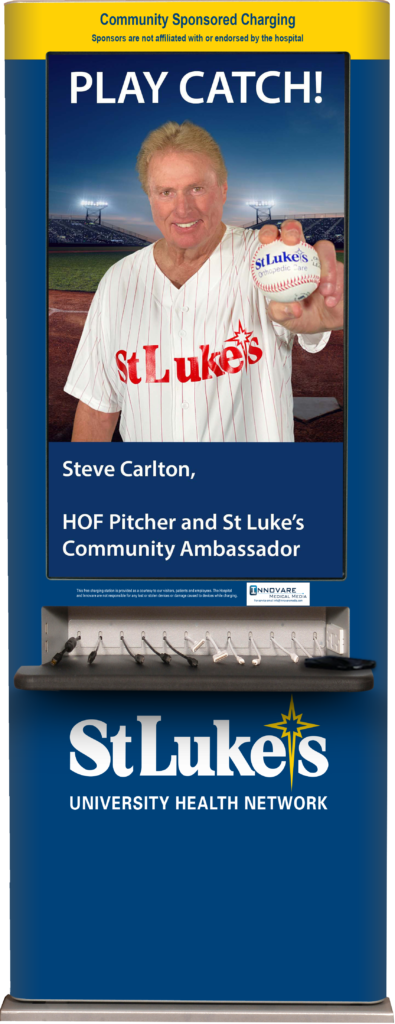

Tune in to Champions Unite on August 25, 2022 Innovare teamed up with The Play Catch Movement to promote the benefits of playing catch to improve the welfare of children and the quality of life for adults through the game of catch.

Innovare teamed up with The Play Catch Movement to promote the benefits of playing catch to improve the welfare of children and the quality of life for adults through the game of catch. Above photograph installed in

Above photograph installed in

We had the opportunity to ask Erik Hartranft a few questions about himself, Innovare Medical Media, and his sales role at the business.

We had the opportunity to ask Erik Hartranft a few questions about himself, Innovare Medical Media, and his sales role at the business.