— Although physicians rarely make house calls and health care providers face declining reimbursements, Long Island hospitals are making a rush to residents’ homes with advertising ranging from TV to radio and from outdoor media to the Web.

They’re snapping up full-page print ads, radio spots during drive time and TV spots that tug at the heartstrings, a bright spot in an otherwise anemic advertising market.

They’re also buying billboards at Long Island Rail Road stations, Long Island Ducks games and the Nassau Coliseum.

The ad spending binge is a bid to capture share of mind in a crowded field of nearly 30 Long Island institutions.

Bill Daddi, a spokesman for Kantar Media, which tracks health care advertising spending, said hospitals, clinics and medical centers in the New York metropolitan area spent $69 million in 2010, up from $66 million 2009. They spent $19.8 million in the first quarter of 2011, up from $15.4 million a year ago.

The North Shore-Long Island Jewish Health System is in the midst of its “biggest campaign yet,” said Don Simon, the system’s vice president of marketing.

“Health care is moving to a consumer orientation where consumers have a greater say in the choice of health care providers. They’re seeking more information,” Simon said. “As a lot of health plans increase deductibles, consumers are being more careful about how they spend their health care dollars.”

While North Shore-LIJ hits home with its “Hope Lives Here” campaign, Winthrop-University Hospital in Mineola has been flexing its marketing muscles with a campaign touting “Your health means everything.”

“We’re spending a bit more than last year,” said Ed Keating, Winthrop’s vice president of marketing, advertising and public relations. “It’s become a much more competitive market, especially in the greater New York metropolitan area.”

Hospitals say they’re spending to build customer loyalty and avoid losing revenue, which would be a one-two punch as reimbursements drop.

“Our goal is twofold,” Simon said. “To create an emotional connection with potential patients as well as provide the community with health care information that will help them make a good health care decision.”

Keating said hospitals need to market or risk being marginalized.

“Left to themselves, people will think of you what they want,” he said. “It’s important to us to make people aware of the excellent medical services we have.”

Although hospital advertising runs the gamut, providers are investing more in Internet campaigns than in the past.

“We know that the Internet is playing an increasing role in how people educate themselves about medical care,” Keating said. “Eight in 10 Internet users have looked online for health information.”

Simon said North Shore-LIJ is using interactive digital banners and linking consumers to information about service such as orthopedics, doctor lists and videos.

“Health care is one of the highest searched areas on Google,” Simon said. “Patients and caregivers are going online to access information that helps them make health care decisions.”

Winthrop positions itself as a big institution amid a sea of smaller Long Island hospitals. Only North Shore University Hospital at Manhasset is larger.

“We’re in the process of changing the perception of Winthrop,” Keating said of the 591-bed institution. “We’re not a small hospital.”

In addition to vying with one another, Long Island hospitals are seeking to dissuade Long Island patients from going to New York City hospitals. Eighteen percent of patients from Nassau County in 2008 went to hospitals elsewhere, primarily New York City.

“Any hospital is trying to do that,” said Janine Logan, a spokeswoman for the Nassau-Suffolk Hospital Council. “We want to avoid the outmigration to New York City hospitals. We’ve got stellar facilities here.”

Winthrop’s Keating said the proof of the wisdom of marketing is in the profits, as good medicine, marketing and reputation keep the hospital healthy.

“It’s working,” he said. “We’re getting great feedback from the community and doctors. We have increased referrals and business, which is the most important thing. Our business is strong.”

Read the Full Post at Long Island Business News

Innovare Medical Media (Innovare) is pleased to announce its 10th Hospital Partnership with Akron General Medical Center (Akron General) in Akron, OH. Michael Ricciardi, Innovare’s New Business Partner, says “Innovare is excited to continue to grow its network of hospitals providing Akron General with an entrepreneurial opportunity to market their services on their own campus and create an additional discretionary revenue stream all at no cost to the hospital”.

Innovare Medical Media (Innovare) is pleased to announce its 10th Hospital Partnership with Akron General Medical Center (Akron General) in Akron, OH. Michael Ricciardi, Innovare’s New Business Partner, says “Innovare is excited to continue to grow its network of hospitals providing Akron General with an entrepreneurial opportunity to market their services on their own campus and create an additional discretionary revenue stream all at no cost to the hospital”.

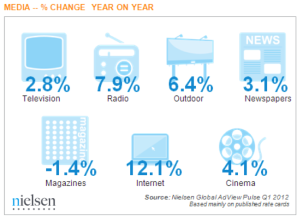

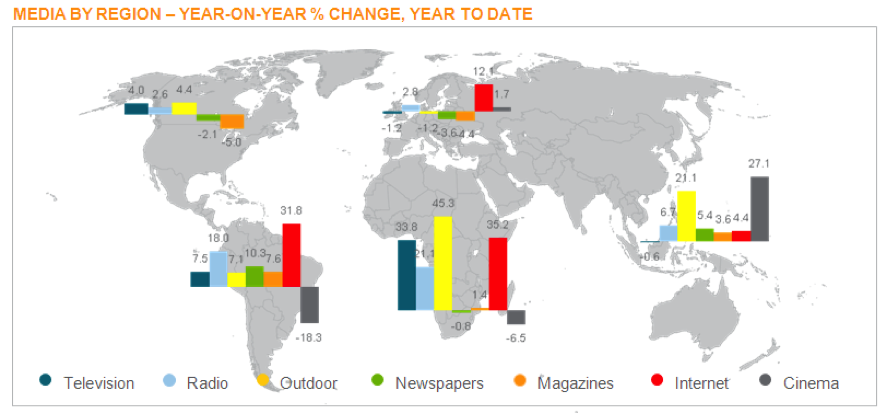

With consumer confidence up and brands looking to reconnect, spending on advertising is on the rise—around the globe and across media types. TV, newspapers, radio, outdoor, Internet, and cinema all saw an increase in ad spend in the beginning of 2012 compared to last year, according to Nielsen’s quarterly Global AdView Pulse report. Though TV continues to attract the majority of advertising dollars, Internet advertising saw the biggest increases, with advertisers spending 12.1 percent more in Q1 2012 than one year prior. During that time, ad spend overall increased 3.1 percent globally.

With consumer confidence up and brands looking to reconnect, spending on advertising is on the rise—around the globe and across media types. TV, newspapers, radio, outdoor, Internet, and cinema all saw an increase in ad spend in the beginning of 2012 compared to last year, according to Nielsen’s quarterly Global AdView Pulse report. Though TV continues to attract the majority of advertising dollars, Internet advertising saw the biggest increases, with advertisers spending 12.1 percent more in Q1 2012 than one year prior. During that time, ad spend overall increased 3.1 percent globally.

Innovare Medical Media (Innovare), launched in late 2010, partners with Winthrop-University Hospital (Winthrop) in Mineola, NY to provide a Community Showcase Display Program on the Winthrop campus. The program will provide Winthrop with various marketing opportunities throughout the campus to reach their current Patients, Visitors and Employees with creative and strategic messages. In addition, Winthrop will receive a new, annual, revenue stream from this Community Program, which can be utilized towards their mission priorities.

Innovare Medical Media (Innovare), launched in late 2010, partners with Winthrop-University Hospital (Winthrop) in Mineola, NY to provide a Community Showcase Display Program on the Winthrop campus. The program will provide Winthrop with various marketing opportunities throughout the campus to reach their current Patients, Visitors and Employees with creative and strategic messages. In addition, Winthrop will receive a new, annual, revenue stream from this Community Program, which can be utilized towards their mission priorities.